Dividend Tax Calculator in UAE

Demystifying dividend taxes in the UAE has never been easier! Whether you’re a business owner, investor, or simply curious about finance, our Dividend Tax Calculator in UAE is designed to simplify your life. No more confusion or complex calculations – just a user-friendly tool offering accurate dividend tax insights. Take control of your financial journey with confidence.

Online Tool for Dividend Tax Calculator in UAE

Discover the simplicity of the UAE’s favorable taxation structure, with nominal taxes applicable only to entities in the gas, oil, and banking sectors. While the overall tax landscape is favorable, specific preferences and exceptions can influence tax calculations. If your business is registered in a free zone, your tax rate becomes zero, covering personal income, dividends, royalty taxes, and foundational levies.

However, navigating the intricacies is crucial, as your home country’s tax rules still apply when doing business in the UAE. Fortunately, the UAE has established numerous international double taxation treaties, providing relief to entrepreneurs and individuals. This article delves into these nuances and introduces our versatile tool for tax calculations: the dividend tax calculator.

Like Dividend Tax Calculator in UAE, You may also like to use Salary and Freelance Tax Calculator in UAE .

UAE's Dedication to Tax Efficiency

The United Arab Emirates government has entered into agreements with over seventy countries, safeguarding citizens engaged in legal business activities from double taxation. This expanding list is poised to attract a wave of foreign entrepreneurs eager to establish businesses in the UAE, driving employee migration enticed by competitive salaries comparable to those in developed Western nations.

Expats conducting business in the Emirates enjoy the advantage of tax exemption across various areas, including assets, dividends, interest, value-added, royalties, capital gains, and income. However, navigating personal taxation intricacies requires attention, and our universal dividend tax calculator proves invaluable in simplifying these complexities.

Simplifying the Complexity of Dividend Taxation

How does one calculate tax on qualified dividends? What are the potential tax implications for directors and shareholders of limited liability companies in the UAE concerning dividend taxes? Consider a scenario where a UAE business owner is a UK citizen. According to the agreement, dividends paid by a UK-resident company to a UAE-resident beneficiary remain untaxed in the UK—except if sourced from real estate-related profits through an investment mechanism. In such cases, UK tax should not exceed 15% of the gross dividend amount.

However, a notable exception arises: if the dividend’s beneficial owner is a pension structure in the UAE, this tax is inapplicable. The complexity of dividend taxation requires consideration of various scenarios. To simplify calculations and expedite the determination of the requisite tax amount, our specialized tool “the dividend tax calculator in UAE” proves invaluable.

UAE Calculators

- Income Tax Calculator

- Value Added Tax Calculator

- VAT Refund & Return Calculator

- Property Tax Calculator

- Hotel Tax Calculator

- Inheritance and Gift Tax Calculator

- Sales and Excise Tax Calculator

- Capital Gains Tax Calculator

- Corporate Tax Calculator

- Salary and Freelance Tax Calculator

- Dividend Tax Calculator

- Small Business & Companies Tax Calculator

- Individual Tax Calculator

- UAE Gratuity Calculator

- UAE Car Insurance Calculator

Our Latest News

How to Check Car Accident History in UAE

If you’re planning to buy a used car in the United Arab Emirates, it’s important to know the vehicle’s background. One of the most crucial steps is learning how to

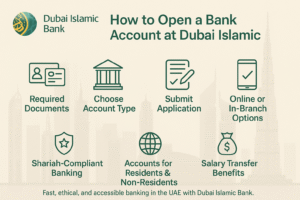

How to Open Bank Account in Dubai Islamic Bank

Opening a bank account is an important step for anyone living or working in the UAE. If you’re looking for a reliable Islamic banking option, Dubai Islamic Bank (DIB) is

List of Government Hospitals in UAE

The United Arab Emirates (UAE) is known for its advanced and reliable healthcare system. Whether you live in Dubai, Abu Dhabi, or any other emirate, access to quality medical care